Team of Alabama A&M Finance Majors Earn High Returns in Investment Challenge

AAMU Team Beats S&P 500 Index in TVA Investment Challenge

When it comes to investing, these students know what they're doing. An AAMU team of

finance majors recently ranked among the top teams in the Tennessee Valley Authority (TVA) Investment Challenge. Out of 26 teams from universities from across the Tennessee Valley, AAMU and 14

other teams beat the S&P 500 Total Tax Return Index for calendar year 2023. That means

they garnered higher investment returns than the S&P stock index, the most common

benchmark for overall stock performance.

“The S&P gained 26 percent but our portfolio gained 30.4 percent,” says Quardell Moore, a senior finance major from Birmingham. “We try to find companies that are under

the radar that are about to increase in revenue and increase in stock prices. We definitely

try to focus on a value investment strategy.”

TVA, the largest public power company in the country, recently held a ceremony in

Nashville to recognize the 250 students who participated in this year's challenge.

“Our team came in sixth out of 26 schools, earning more than $4,000 for our department,” says Dr. Mohammad Robbani, Professor of Finance, Department of Accounting and Finance. "It is a very important program for us. We started in 1998. The TVA created this program out of their nuclear decommissioning fund for nuclear plants they are taking out of service, which takes billions of dollars.”

Robbani says at that time, TVA gave 20 schools $100,000 each to invest with a goal to generate funds and give students the opportunity to learn how to manage money.

“It's real money students use to buy and sell stock and manage their stock portfolios,” he says. “We now have a portfolio of half-a-million dollars. If it gains money, the next year they take out the excess amount, then we begin with $500,000. It is the TVA’s money, but it’s an excellent way for our students to learn.”

The challenge is mandatory for students enrolled in Spring Investment 1 and Fall Investment

2 classes. Students manage a portfolio typically inherited from the previous investment

class cohort.

“We just rolled over the stocks that we bought from last year and it trickled into

this year," says senior Engtavius Briskey Chappell of Tallassee, Alabama. "Some of the companies we have are from 2019 on.”

Students say investing their time in and out of class for an entire year is the reason they performed so well.

“We’re not financial or investment managers, but as a group we actually take time to meet up and research and discuss an investment strategy in order to be able to place high in competitions like this,” says Chappell.

“It was a great learning experience,” says Amoni Crittendon from Ozark, Alabama. “It taught me to invest in a real-world learning experience and portfolio management, and branch out and work with my classmates.”

“We learned about the different sectors within the stock market and comparing them to the S&P and making decisions to buy and sell from there,” says senior Daevon Seawood of Grand Rapids, Michigan. “You need to diversify your stocks, not have all your eggs in one basket.”

Students also offered some advice from what they learned in the challenge.

“You may see a company that you like personally, but it may not be the best thing to invest in,” says senior Triniti Moore of Huntsville, Alabama. “Look at how the company’s doing overall, not just financially, but look at what’s going on in the media. Are there negative things out there? Because that also influences how the stock will go.”

“Everyone has a different investment process,” says senior Elijah Lee from Atlanta. “Of course, we have to use quantitative data, but I also like to use qualitative data. I feel like if there’ s a good story, there’s s good chance that company will do well.”

The team has also found success outside of the classroom. Lee, who has interned with AllianceBernstein in New York and Nashville, has accepted a job in financial risk and advisory with Deloitte in Huntsville. Quardell Moore has a financial analyst internship this summer with Lear Corporation in Indiana. Triniti Moore is interning with a capital funding organization in Birmingham. Seawood is interviewing for a position in Atlanta and has a job offer from a recent internship. Chappell and Crittendon say they are keeping their options open.

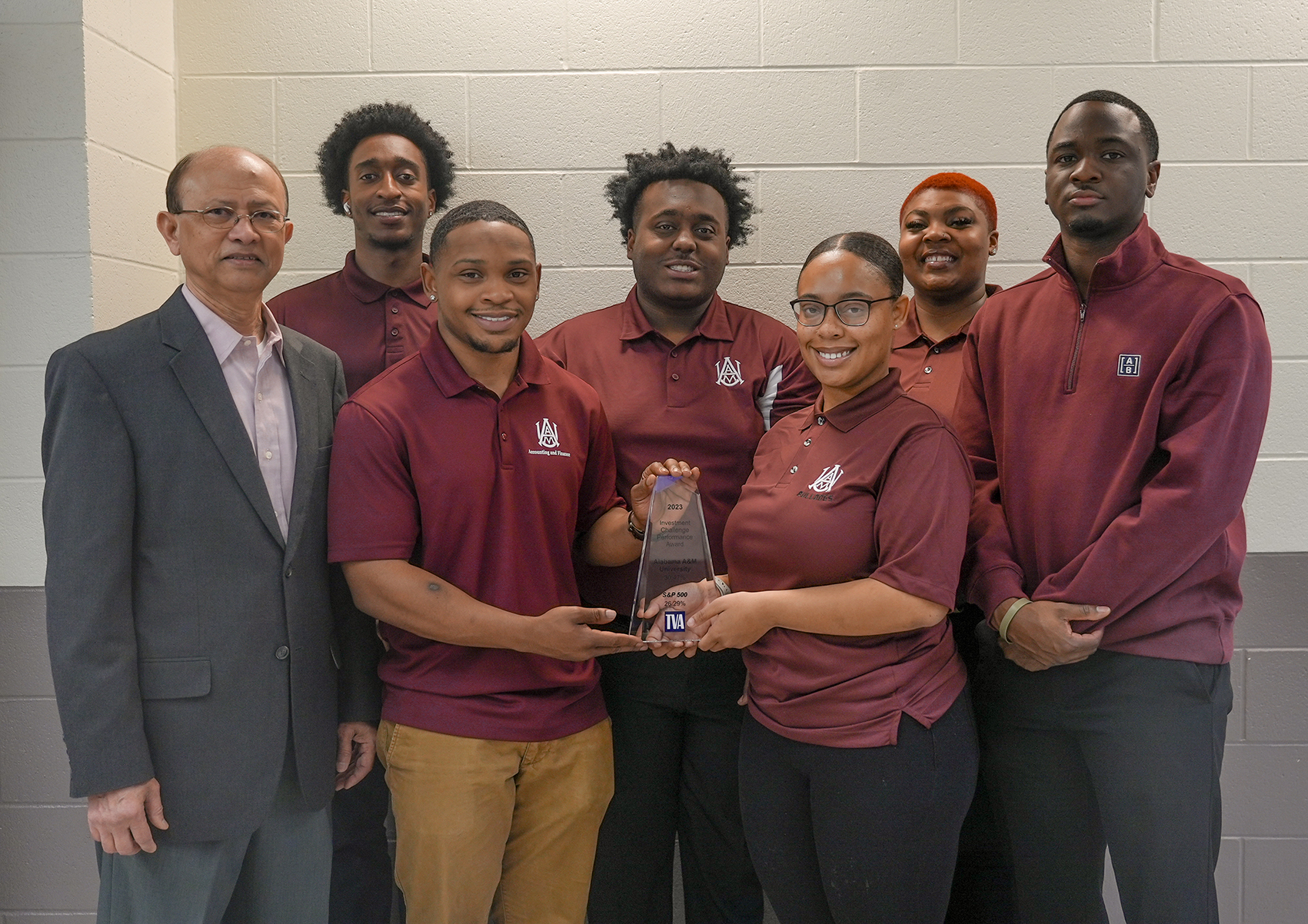

(Photo L-R) Dr. Mohammad Robbani, Daevon Seawood, Engtavius Briskey Chappell, Quardell Moore, Triniti Moore, Amoni Crittendon, Elijah Lee